The GIFT City Revolution in Indian Venture Capital

Indian venture capital is experiencing a significant shift. With founders increasingly moving to global markets, especially San Francisco's AI hub, VC funds are following suit. However, instead of traditional offshore routes like Mauritius, a growing number of funds are choosing Gujarat International Finance Tec-City (GIFT City) as their preferred destination.

Major VC firms including Blume Ventures, 3one4 Capital, Stellaris Venture Partners, A91 Partners, and Z47 have already established offices in GIFT City. Private equity giants like Kedaara Capital and Multiples have joined this migration too.

Understanding the GIFT City Advantage

Why Traditional Offshore Routes Fall Short

SEBI-governed Alternative Investment Funds (AIFs) face three major limitations:

- Currency Conversion Hassles: Default investments in Indian Rupees require extensive paperwork and SEBI approval for currency conversion

- Foreign Investment Caps: SEBI places strict limits on overseas investments

- Administrative Burden: Complex approval processes with authorized dealers and banks

GIFT City's Game-Changing Benefits

GIFT City addresses these challenges with:

- No Overseas Investment Limits: Unlike SEBI-governed funds, there are no restrictions on foreign investments

- Tax Exemptions: Companies can avail significant tax benefits under the GIFT City structure

- Foreign Currency Operations: Easy setup and operation of foreign currency funds

- Streamlined Administration: Simplified regulatory processes compared to traditional Indian fund structures

Actionable Steps for Setting Up Your Fund in GIFT City

Phase 1: Initial Planning and Assessment

- Evaluate Your Investment Strategy: Determine if your fund plans significant overseas investments

- Assess LP Preferences: Gauge your Limited Partners' comfort with GIFT City structures

- Compare Tax Implications: Analyze GIFT City benefits versus current offshore arrangements

Phase 2: Regulatory and Compliance Setup

- Engage with IFSCA: Work with the International Financial Services Centers Authority for registration

- Establish Physical Presence: Set up the required office space in GIFT City

- Banking Relationships: Establish relationships with banks for currency conversion processes

Phase 3: Operational Implementation

- Staff Training: Ensure your team understands GIFT City regulations and processes

- Documentation Setup: Prepare all necessary legal and compliance documentation

- LP Communication: Keep Limited Partners informed throughout the transition process

Challenges to Navigate

Banking and Currency Issues

Fund managers report that currency conversion from INR to USD can take 3-6 months to finalize. Plan for these timelines in your setup schedule.

Regulatory Uncertainty

Unlike established offshore jurisdictions, GIFT City's tax implications are still evolving. Work with experienced tax advisors familiar with GIFT City structures.

Office Mandate Requirements

The requirement to maintain a physical office adds operational costs and complexity compared to some offshore alternatives.

The Role of Professional Financial Management

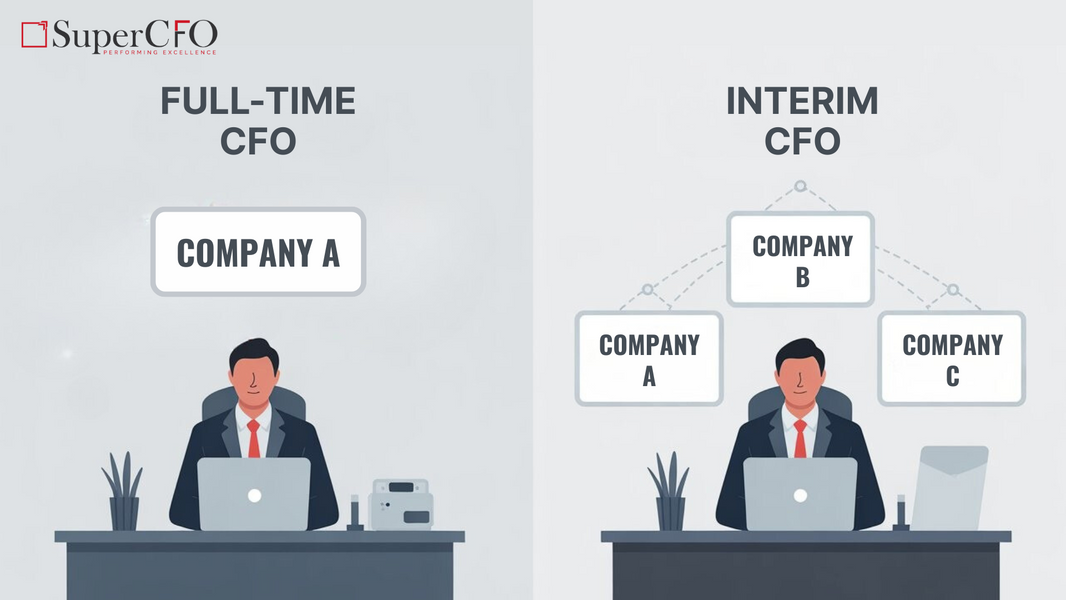

Setting up and managing a fund in GIFT City involves complex regulatory, compliance, and financial requirements. Many successful funds start with virtual CFO services to navigate initial setup challenges, ensure compliance, and manage regulatory requirements efficiently.

As your fund grows and investment activities increase, you can transition from virtual CFO support to a full-time CFO role. This approach allows you to:

- Access specialized GIFT City expertise without full-time hiring costs

- Ensure compliance from day one

- Scale financial management as your fund size increases

- Focus on investment activities while professionals handle operational complexities

Industry Growth and Future Outlook

Current data shows 255 Alternative Investment Funds registered in GIFT City, indicating strong industry adoption. This growth aligns with the increasing India-US investment corridor, particularly in AI and technology sectors.

Fund managers report that GIFT City regulators demonstrate willingness to adapt policies based on industry feedback, with policy changes possible in 3-4 rounds of discussions rather than lengthy processes.

Making the Decision: Is GIFT City Right for Your Fund?

Consider GIFT City if your fund:

- Plans significant overseas investments

- Wants to avoid complex SEBI currency conversion processes

- Seeks tax optimization opportunities

- Values regulatory flexibility and responsiveness

- Has Limited Partners open to India-based fund structures

Conclusion

GIFT City represents a strategic opportunity for Indian VC funds looking to expand globally while maintaining domestic advantages. While challenges exist, early adopters report positive experiences and growing LP acceptance.

The key to success lies in proper planning, understanding regulatory requirements, and having the right financial management support from setup through growth phases.

Looking to set up your fund in GIFT City? Professional CFO services can help navigate the complex setup and compliance requirements, ensuring your fund starts on the right foot.